Things to Consider When Establishing or Reevaluating a Membership Program

Starting a new membership program isn’t as easy as naming your membership levels gold, silver, and bronze then picking some prices and throwing them out to the public for purchase. You must take time to think through the lifecycle and management of your membership program. Let’s take a look at some of the things to consider whether you’re establishing a new membership program or you’re reevaluating your existing program.

Start Dates

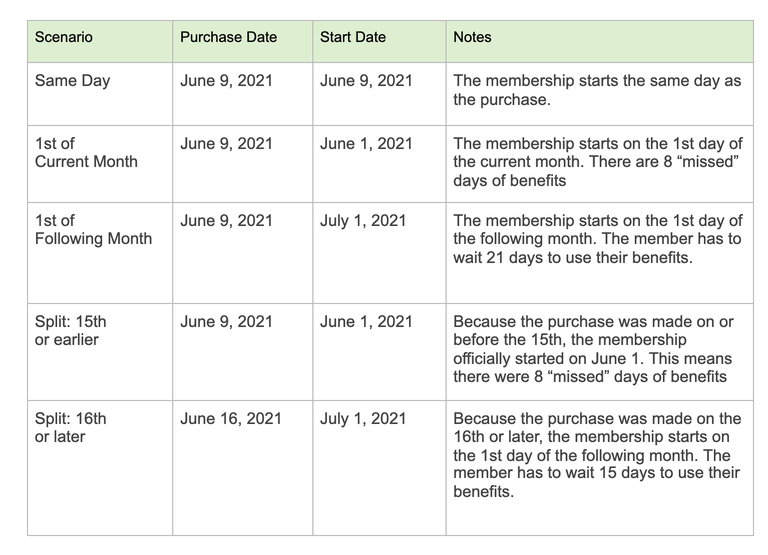

The first thing you need to determine is how your membership dates will be calculated beginning with the start date. For example, will a membership always start the same day a membership package was purchased? While that’s not the only option, starting on the day of purchase is the cleanest way to set up your program and is straightforward to both you and your members. Your new member’s benefits go into effect immediately and you don’t need to take the extra time to jump through hoops to calculate dates.

An alternative option is to start memberships on the 1st of the month. If a membership is purchased on the 1st, the member’s benefits will start right away. But what if they purchase their package on the 2nd? On the 14th? On the 28th? You’ll need to come up with a plan to determine when these members’ benefits go into effect. Will it be the 1st of the following month or will the benefits be enabled retroactively to the 1st of the current month? Or is there a split in the middle of the month where the earlier purchases are retroactive to the 1st of the current month and the later purchases wait until the 1st of the following month? Here are some pros and cons of these alternate scenarios:

1st of the Current Month

Always going with the 1st of the current month means that there will be a select number of days where their membership benefits were technically active, but the member couldn’t use them because they hadn’t actually made their purchase yet. Folks who make their purchase toward the end of the month are kind of out of luck...it’ll be like they paid for a 12 months membership but were only able to use the benefits for 11 months.

1st of the Following Month

Always going with the 1st of the following month means that a member will have to wait a select number of days before being allowed to use their benefits. This isn’t too bad for someone who makes their purchase on the 27th, but not so much for people who made their purchases on the 3rd

Split the Month

The kindest thing to do if you’re determined to have a membership start on the 1st would be to “split” the month and, for example, say that memberships purchased on the 15th or earlier will be active as of the 1st of the current month whereas memberships purchased on the 16th or later will be active as the 1st of the following month. Members will still either “lose” some membership days or they’ll have to wait, but it’s not as much as if you were only doing one or the other.

Let’s look at real dates to see how each of these scenarios would play out…

This brings me back to my original point. Starting a membership on the day of purchase is the cleanest way to set up your program and is beneficial to both you and your members.

End Dates

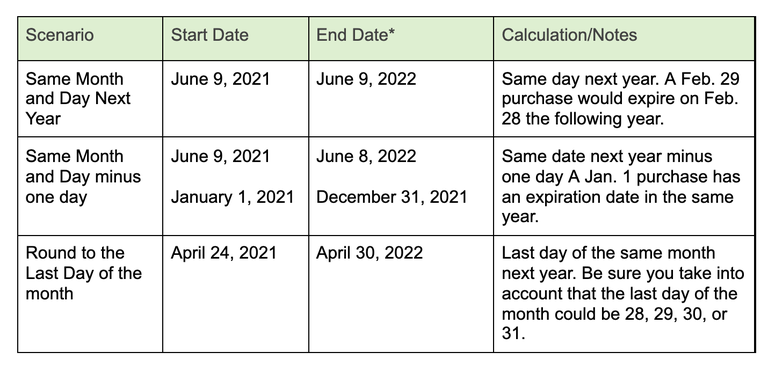

In the interest of keeping things more manageable for our end date scenarios, let’s assume you decided to set the start date as the purchase date. Next, we need to talk about the end date for memberships. Happily, end dates are a little less complicated than start dates. For an annual membership, you’re typically looking at 365 days from the start date or, if you want to be more specific, you can calculate the expiration date as the same date of the following year, or the same date of the following year minus one day. If you select the latter calculation, be sure you pay attention to the following date complications:

- January 1st where the end date would be December 31

- February 29th of a leap year where the end date would be February 28th of the following year

- March 1st of the year prior to a leap year where the end date would be February 29th of the following year

Similar to our start date examples above, you may decide to round the end date of your membership to, for example, the last day of the month. Again, this adds more complexity to your process, but it’s doable. I must question the fairness of the setup, though. If I compare my membership purchased on June 3 to someone else’s membership purchased on June 27, both memberships will expire on June 30, 2022. Sadly, the other member would have far fewer “extra” days to use her benefits.

Let’s look at real dates to see how our end date scenarios would play out…

*Note that if you go with the Split option for the start date, the end date will NOT be split and will follow one of the rules above.

Make sure you do not penalize members for renewing early, either. Make sure you set (or build automation to set) the starting date for the newly renewed membership the same day or the day after the current membership expires. You don’t want to take away a month or more of the benefits the member has already paid for.

Grace Period

NPSP allows you to define a grace period. A grace period is a specified number of days after the expiration date where a member can continue to use their benefits, carry over unused benefits, or, for example, take advantage of a discounted rate/renew at the existing member rate rather than the new member rate. A grace period is a nice thing to offer in case circumstances prevent a member from renewing on time (pandemic anyone?), but you also don’t want to be so generous that members take advantage of you. Think about what you want your grace period to be. Should it be 1 week? 1 month? Something longer? A one-month or 30 days grace period is fairly standard practice.

Retention and Renewals

Naturally, if you’re selling memberships, you’re going to want those members to renew, and you don’t want to wait until your first members start expiring to put a plan in place. You may have heard this before, but it bears repeating, it’s less expensive and more profitable to retain customers, or in this case, members, than it is to acquire new customers (Source: Calculate and improve your customer retention rate - Salesforce.com).

That makes the management of your renewal process one of the most important and potentially one of the most challenging aspects of any membership program management. Here are some things to think through after you’ve decided how you’ll calculate your membership expiration dates...

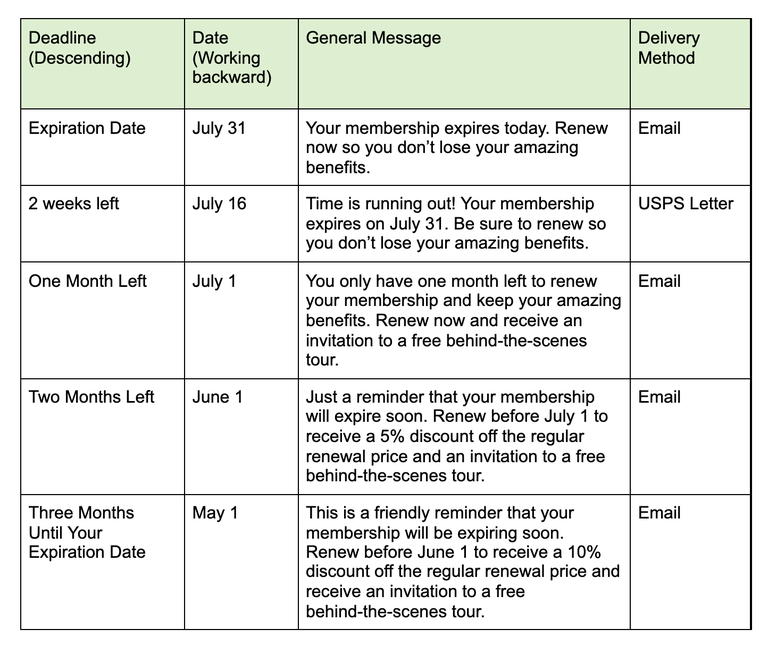

Ideally, members will renew prior to their expiration date, so it’s a good idea to give them more than just a few weeks to take action. If you follow the Marketing Rule of 7 (Google “marketing rule of 7” and you’ll get 225M results) you’re going to be reaching out to that soon-to-expire member multiple times. Since your members have already taken that all-important first step in interacting with your organization hopefully, you won’t need 7 “touches”, but you’ll definitely need to plan on more than one.

Next, think about what channels you’ll use to reach your members. While convenient for you, not everyone utilizes email. Do you know who regularly interacts with your emailed content? (Hint: you should!) If so, consider segmenting your renewals into two lists: a path that relies primarily on email with, perhaps, a final reminder via USPS and a path that relies more on snail-mail with, perhaps, a final notice via phone call.

An ever-popular option with nonprofits is to offer an “early bird” discount for those that renew prior to a defined deadline. But an early bird incentive does not have to be a discount...or at least not only a discount. Instead (or in addition), you could offer a physical item such as a reusable tote bag or even something intangible like an invitation to a special event or behind-the-scenes tour. The secret is to find a combination that’s appealing to renewing members but doesn’t break your budget. Your incentive doesn’t have to be one-and-done either. Maybe members get a 10% discount if they renew after their first reminder but only get a 5% discount if they renew after their second.

Once you’ve taken all of the above into consideration, create a timeline and work backward to calculate how long before a member’s expiration date you want to start sending messages. See the example below utilizing up to 6 email messages and one USPS letter to reach out to the member. Note how the messages start out with a friendly tone and offer incentives, then the closer we get to the expiration date, the incentives disappear, and the urgency increases.

Be sure you take advantage of renewal messages and encourage members to renew at a higher level (and even give an additional donation). For more, see the “Upselling, Add-ons, and Donations” section below.

Movement

In addition to start and end dates and membership levels, there are two additional metrics you’ll want to track about your members. Both are related to their shifts within the program.

NPSP Membership Records have a picklist (i.e. drop-down) field called Membership Origin. In this case, origin refers to how/why the membership sale was entered. Was it a new member, a renewing member, or a rejoining member (i.e. their membership lapsed but now they’re back)? Those options are pretty straightforward, however, you will need to define how you want to classify folks who renew during their grace period. Technically, their membership has expired so are they still a renewal? On the other hand, if their membership expired just a few days ago, do they really belong in the rejoin category? Perhaps the best option would be to add an additional picklist value (e.g. “Renew GP”) to specifically track members who renew during their grace period. A “Renew GP” option will also let you track the folks who always wait until the last possible minute to renew which would help you refine your message to that particular group of people.

The other metric I like to track is whether or not renewing or rejoining members renewed (or rejoined) at the same membership level, upgraded to a higher level, or downgraded to a lower level. For example, if a lot of people are upgrading their membership, you should examine what has caused them to do so (and perhaps you have some wiggle-room to raise your prices). Conversely, if you’re seeing numerous downgrades, that may be a sign your prices are too high.

Cards

Traditionally, membership cards have been physical cards...either plastic, plastic-coated paper, or simply heavier card stock. With the invention of smartphones and utilities such as Apple Wallet and Google Pay, people nowadays are going to expect the option to have digital cards. That’s not to say that physical cards are out. There are still plenty of people who don’t have a smartphone or prefer a physical card. Either way, you need to be prepared to deliver cards to members.

Utilizing digital cards typically means contracting with an add-on service that will generate a QR code, generate the wallet item, and send it to the member. Physical cards will require functionality to generate QR code’s or barcodes, a specialized printer and associated software to create that hard plastic card (not to mention the cards themselves), or special stationery where you can perform a mail merge to create a letter with a peel-off a coated paper card. If you plan to offer both digital and physical cards, you’ll need to coordinate between the two vendors to ensure the system you use to scan cards (another service contract required) can accept codes possibly generated by two different sources.

Benefits

Most memberships come with some type of benefits attached. Some of those benefits are tangible, such as a tote bag, mug, or water bottle. Other benefits are intangible such as discounts on merchandise, free admission to your facility, or invitations to exclusive special events. Think about how you are going to track who’s receiving which benefits, how you fulfill them, and how you track their redemption.

On the fulfillment side, you’ll need a system in place to keep track of your inventory of tote bags, mugs, etc. You’ll also want to make sure you get those items into the hands of your members. Are you willing to pay for shipping or have a vendor manage and fulfill these items? If not, perhaps the member should be instructed to pick up the item on their next visit. It’s a great way to encourage a member to visit you sooner rather than later!

You’ll need to track the fulfillment of discounts as well. If a discount is good in your shop or in your cafe, how will the staff know the person is a member to offer them the discount? Or confirm they’re a member when the person asks for a discount? Will they have access to Salesforce to look up the member? Do you have member cards that get scanned?

For those that opt to include invitations or free admissions to events, you’ll need to create a system that allows you to track RSVPs and redemptions. Salesforce Campaigns are a great way to handle RSVPs to a specific event (see the resources below). You might be able to adapt Salesforce Campaigns to track event admissions as well, though a custom solution or 3rd party application from the Salesforce AppExchange may suit your needs better.

Lastly, are you up on your rules about how much of a membership’s cost can be tax-deductible? If you offer benefits such as a mug or tote bag, you may need to deduct the fair market value (FMV) of those goods from the amount the member can claim as a deduction on their taxes. U.S. Nonprofits can read up on the rules for charitable contributions in this article on the IRS website.

Joint Memberships

Will your program allow members access to other organizations? For example, if you’re a museum in a city with multiple museums, does a membership with you allow members to access other local museums for free or at a discounted rate? Or perhaps you sell a joint membership? If you’re the local art museum, can a member pay an additional cost to also become a member of the local history museum?

If you answered yes to any of the above scenarios, there are two considerations to make. Firstly, you’ll need to be able to share these joint members with your sister organization (unless all your member has to do is to show their member card with your org). How does your sister org need to see that information? Will you send them a report? Will it be in Excel? How should the report be sorted? And how will you identify/track your sister organization's members visiting you?

Secondly, and more importantly, if an extra fee is being paid, how are you accounting for that money? You want to ensure that you’re paying your sister org the correct amount. Your best bet is to establish automation that can identify you’re selling joint memberships and create separate GAU Allocation records so you can clearly report on how the income is to be split.

Upselling, Add-ons, and Donations

When we talk about upselling in regards to memberships, we’re actually talking about two possible approaches. One, come renewal time, you want to encourage members to renew and, if possible, renew at a higher level. Think about the ways you can make upgrading to a higher membership level an enticing prospect for renewers. Perhaps you offer an additional benefit (e.g. a one-time 50% discount off of your shop purchases) or maybe a discount that’s large enough to get renewing folks to take the bait (as it were) but not so large it becomes a turn-off the following year when you want them to renew at the full price

Two, consider selling “add-ons” as part of your sales process. For example, if guests have to pay to park at your facility, offer the convenience of allowing them to pay in advance (at a discounted rate, of course). Or maybe members can add additional guest admission passes (again, at a discounted rate).

Another thing any nonprofit worth its salt will want to encourage is to add a donation on top of the price of their membership. Whether a member decides to add a flat amount or to round up their purchase price by $10, $20, or $30, every dollar on top of a membership purchase price is a bonus. Consider making it easy on your buyers pricing your memberships so that adding a “round up” donation is easy. For example, you can make your membership price $210 and encourage your member members to give an additional $40 to make a pleasing total of $250.

Happily, all of the above can be managed in Salesforce and NPSP. Just like I mentioned in the Benefits section above, you’ll want to have a plan in place to manage fulfillment (e.g. ensure your parking attendants have a way of identifying and confirming members who paid for parking in advance). You’ll also need to track the FMV of any add-on items and calculate the actual tax-deductible amount of the transaction.

Payments

Let’s be frank, a key reason behind offering memberships is not only to get people in the door, it’s to get money in the bank on a regular basis. To achieve this, your best option, of course, is to have members pay upfront and in full, but that may be difficult for people on a tight budget.

Then there’s the “Netflix” model where members pay on a monthly basis. This will allow for more flexibility for members on a budget, but it has its drawbacks. Here is a list of things you’ll want to consider if you’re thinking of offering monthly payments:

- Will monthly payment members have a rolling expiration date (e.g. as long as I pay by June 30, my membership is good for the month of July)?

- Will you offer a grace period if monthly members don’t renew and pay on time? If so, how long will that grace period last? 3 days? 7 days?

- Will monthly members pay at a different rate than full members as a part of the convenience? For example, you could offer a “Silver” membership for $100 per year, but the corresponding monthly membership is $10 per month working out to $120 per year.

- Will monthly members be able to cancel at any time? If so, what will that do to your cash flow?

- Will monthly members receive the same benefits as members who pay upfront or will you offer a smaller/lower value benefits package?

- Do you have a way to charge credit cards automatically each month? Will you be able to track that the payment went through successfully or if it was declined?

- What is your plan for approaching monthly members about becoming “full” members? About approaching them to donate? About upselling (e.g. paying for parking)?

To avoid starting a program where the genie cannot go back in the bottle, consider advertising your monthly member option as a pilot program that is only available for a limited time. That way you’ve advertised it well in advance if you decide you do need to pull the plug.

The One Wrong Answer

Whether you’re establishing a new membership program from scratch or you’re reevaluating your current membership program and talking through your current procedures and policies, the worst way to make a decision is to simply say, “That’s the way we’ve always done it” or “that’s the way we did it at my old job.” Take your time and think through the above points carefully and map out your plan in detail.

Resources

Ready to learn more about configuring memberships in NPSP?

- Check out this Arkus blog post from Berkeley Baker called Quick Tips for Managing Memberships with NPSP Using Quick Actions and Workflows

- View the full documentation for memberships in NPSP on the Power of Us Hub under Create and Manage Memberships.

- You can follow the Membership topic as well as other related topics in the Power of Us Hub

- Learn how to track event RSVPs in the Campaign Management with Nonprofit Success Pack module on Trailhead

Questions or Additional Recommendations?

Are you getting ready to launch a new membership program? Reach out to me with any questions. Or perhaps you’re in the middle of reevaluating your current membership schema. What have you learned from the process? Feel free to comment in the Salesforce Trailblazer Community or chat with me @emadram.